Crypto Has Forgotten its Founding Principles

From an innovative tool designed to combat the State’s monetary monopoly, to a buzzword for unscrupulous speculators and scammers.

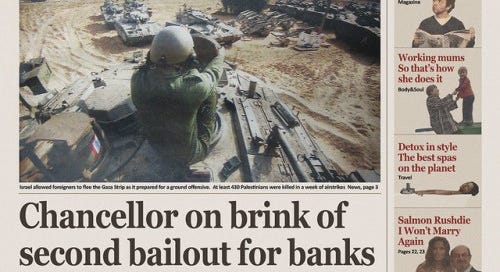

Etched into the genesis block of Bitcoin is:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

This note, referencing the newspaper headline above, accompanies Bitcoin’s first ever transaction, executed by the mysterious founder Satoshi Nakamoto. This cryptic message and other explicit statements contained in the Bitcoin white paper indicate the founder’s intent for Bitcoin: A currency absent third-party oversight (including from government) and separate from the devastating economic cycles brought on by arbitrarily determined interest rates, ever-expanding money supply, rampant speculation, and State-sponsored bailouts. Therefore, it’s no surprise the invention of Bitcoin inspired a slew of Ron Paul-idolizing, Federal Reserve-chastising blockchain developers, sparking an early renaissance in decentralized tech. Today, in a cruel irony, this asset class has instead become the epitome of speculation, inflation, and manipulation with more than 17,000 different currencies, many with an elastic supply at the discretion of the issuer. Consequently, the majority of today’s crypto “investors” are oblivious to blockchain’s original purpose.

Early pioneers like Vitalik Buterin (founder of Ethereum), Charles Hoskinson (Cardano), and Eric Vorhees (ShapeShift) were not only brilliant technologists but staunch Libertarians united on a mission to spread individual sovereignty. One of the earliest and largest venture capital firms in crypto is Blockchain Capital, founded in 2013. According to founder Bart Stephens, “A lot of crypto has its roots in libertarian thought and empowering individuals and we want to see the values of the industry reflected in the values of the founder.” These ideals, sought by crypto’s Old Guard, formed the long-forgotten value proposition that initially took these assets “to the MOON”. Sadly, early success attracted a new crowd with little interest in ending monetary coercion and who simply want, as Epsilon Theory’s Ben Hunt puts it: “number go up”.

Laser eyes, “have fun staying poor”, over 20 dog-based currencies, JPEGs selling for millions of dollars, Jake Paul just being involved, Tether likely a total fraud, flexing with pictures of monkey heads, “The Metaverse” (basically a made-up redundant term for online video games), Max Kaiser shrieking on-stage in Miami… This is what losing your purpose looks like. The immense success and unifying effect of crypto’s original mission has given rise to a burgeoning collective of hubris and nihilism.

Why does all this matter? The crypto community no longer knows what to preserve, as demonstrated by the cheerleading for more regulatory oversight from the financial crowd:

Note the rationale: regulation will increase institutional adoption, i.e. broaden the pool of speculators, not provide any sort of functional advantage. The excitement is perverse. Freedom from the fallible and manipulative governance of Man is precisely why the inefficiencies of Blockchain are tolerated. Remove this, and you’re left with a slow version of QuickBooks.

Take a look at the first sentence of the Bitcoin white paper. It reads, “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.” This ideal is quickly diminishing. Per the Biden admin’s infrastructure bill, all crypto exchanges must have their customers submit a 1099 tax form and crypto holders must report any trading activity. Additionally, the SEC has signaled its intent to regulate crypto as securities. Build Back Better Bill, if passed, will further this initiative by applying Wash Sales and Constructive Sales laws to digital assets. Pretty soon we will have to change the name to “Crypto-securities”. You may find these initiatives practical, but they undeniably a downgrade Bitcoin’s original proposition of “electronic peer-to-peer cash” to something lesser, and the regulators are just warming up...

Listen to Canada’s Minister of Finance (and WEF Board of Trustees member), Chrystia Freeland, announce her plan for “broadening the scope of Canada's anti-money laundering and terrorist financing rules so that they cover crowdfunding platforms and the payment service providers they use. These changes cover all forms of transactions, including digital assets such as crypto currencies...”

This comes after the Canadian truckers, who have been protesting vaccine mandates, raised over $900,000 in Bitcoin after being denied access to the millions raised through crowdfunding apps. Freeland, later in this speech, states explicitly, “This is about stopping the financing of these illegal blockades.” The Canadian government actively building bureaucracy around preventing voluntarily crypto transfers between two parties… please tell me how that’s bullish Mark Cuban, I’ll wait.

The assault continues. Consider Biden’s rumored executive order on crypto regulation. According to Barron’s, the National Security Council will be involved “because digital assets don’t stay in one country, it’s necessary to work with other countries on synchronization,” the anonymous source said.

Recall DeFi’s core value proposition: banking the unbanked and eliminating exploitative remittance fees. Western Union, one of the largest financial services companies in the world, does not charge 20-40% remittance fees due to some technological impediment that DeFi solves, for proof see Venmo. WU charges these exorbitant rates because of cumbersome regulations associated with international transfers and foreign exchange markets. These reduce the number of smaller competitors who can’t afford the cost of compliance, resulting in even more pricing power for WU. DeFi eliminates exploitation by subverting this bureaucracy. How exactly is Biden proposing to incorporate crypto into the very apparatus which spawned these inefficiencies and high costs beneficial?!?

These proposals are only the beginning. No government willingly relinquishes its monopoly on the money supply, so the natural solutions are ban crypto outright or regulate away its utility. China tried the former. The US seems to be opting for the latter. Canada… well… we’ll see. As jurisdiction over crypto transactions is ceded to regulators, crypto’s inherent value weakens. Crypto advocates ought to be fighting this trend, not convincing themselves that it’s beneficial. A community cannot rally to face an adversary which they perceive to be an ally. So ironically, at the crux of a legislative wave that will greatly weaken crypto, the prices remain high and the community remains complacent.

Mocking gold as the inferior inflation hedge is a favorite pastime for even the most bandwagon crypto fans. Gold, like crypto, can also be viewed as an anti-State monetary tool, and the associated challenges can be applied as well. Remember, FDR banned private stores of gold in 1933, ostensibly to fight the Depression (in reality: fund The New Deal through currency devaluation). However, some key traits that differentiate gold from crypto in today’s climate include: a community that understands its value, far less regulatory scrutiny, recent underperformance, and industrial/ornamental base demand resulting in price stability. I think we may be surprised in the coming months how this boomer-metal performs as crypto discovers that revolutionizing the global financial system is no trivial task.

To be clear, I think some cryptos are powerful anti-State tools, but this is not even a thought that comes to mind for the current majority of speculators. In my opinion, Bitcoin’s underlying utility increases as the State one lives under becomes more authoritarian. To see this, I strongly encourage reading Carlos Hernándes’ personal story. He is a Venezuelan refugee who overcame hyperinflation and an oppressive regime by employing Bitcoin for simple acts like buying milk and crossing the border with only the clothes on his back. To Carlos, Bitcoin’s volatility was less relevant while its maneuverability and discretion were paramount, qualities in which it greatly surpasses gold. Now ask yourself, would it have been “bullish” for Carlos Hernándes if Maduro had previously incorporated “crypto-fiat on/off ramps” into Venezuela’s “regulatory framework”?

The time to buy into crypto will be when it becomes illegal in the Western World or if certain coins that are particularly geared towards State subversion become illegal - privacy coins like Monero and Zcash. This will shake out all the foolish speculators and will be the only dip worth buying. And coincidentally such a move by governments would indicate that you may soon be dealing with the sort of leaders whom you might need to subvert.

P.S. If anyone has tips on crypto exchanges that would likely continue to operate in the event of a regulatory crackdown or particular tokens which protect users from surveillance, please share in the comments.

The unfulfilled hopes for crypto parallel the disappointment I have felt with the internet overall. Who would have imagined that it would become the ultimate tool for government surveillance of the population and for corporate domination of discourse? Cryptocurrency may now become the gateway to UBI and allow governments to have unprecedented granular control of the distribution of resources.

Crypto is best as a prepping tool, but it has failed to solve any real problems in the current economic system. When a crisis hits, it can be useful, but it doesn't revolutionize the whole economic system to make it truly better.

One reason is because the crypto folks are focusing only on the money-side of a transaction. Now you can send valuable tokens to other people, peer-to-peer, without third parties. But what about the other side of the transaction? If you want to buy and sell good and services, there must be a way to deal with that side, too.

This is why the cryptoscene is full of scammers. They can be sure that when the transaction is made, they will receive their money. But it's very easy to not keep their promises of goods and services or other form of value to the other party. They can just take the money and run. Nobody will help the victim.

Crypto economy is like a third-world country. You cannot really trust anyone, so you have to be very careful who you deal with. And even then you can lose a lot of money. That's why we are not seeing any productive business coming out from crypto. It's all just gambling. People are hoping to get rich by acquiring tokens which will go up in price. Nobody is producing new goods and services which would make the whole society wealthier.